The solution flexibly covers a wide range of security requirements. The technology is based on secunet protect4use, a user-friendly authentication solution for web services which supports all relevant platforms and browsers. In addition, tax consultants generally also have the option of using the procedure.The new authentication path is particularly easy for users, as they can utilise their smartphone as a token and do not need any additional hardware. You can find this under "Further information".Īccess to ELSTER is possible via any terminal device with a compatible Internet browser. For more details, please refer to the leaflet "Handling receipts". Paper receipts/donation receipts no longer need to be submitted, but must be retained. However, for tax returns that by law may only be filed electronically - such as the trade tax return - there are no longer any forms stored in the Form Management System. However, paper forms are also available at every tax office.

The tax forms can be found on the Forms Management System (FMS) page of the Federal Tax Administration, see "Further information".

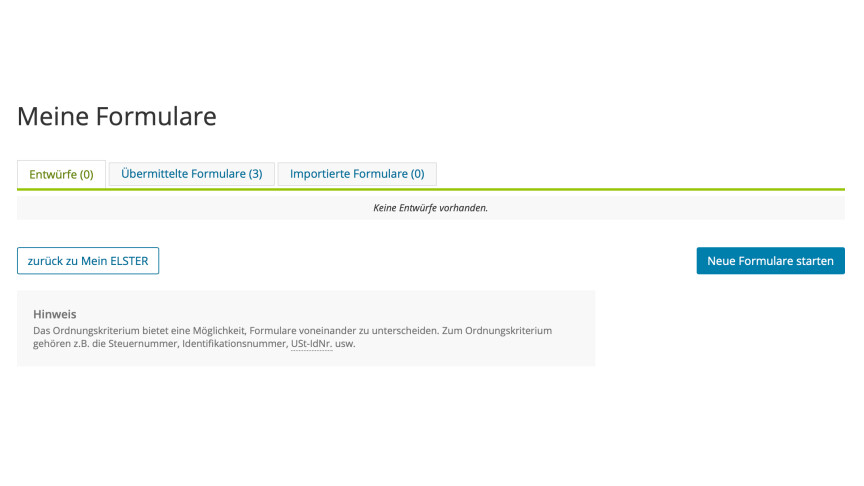

Transfer of data from the previous year,.The tax administration's ELSTER service portal has been set up at for the electronic submission of tax returns.ĮLSTER is the tax administration's platform-independent service portal that enables the paperless submission of tax data via an interactive web application with maximum security, quickly and conveniently.īenefits and advantages of electronic submission:

0 kommentar(er)

0 kommentar(er)